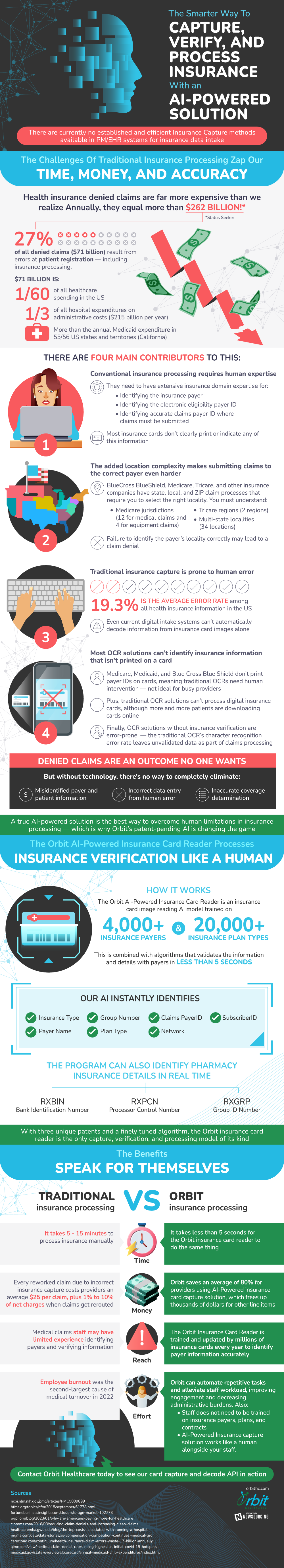

Hundreds of billions are filed for through insurance and are denied yearly. The majority of this is due to improper claims, weak coverage, and other logistics and business issues. Yet almost 30% of all denied claims come from registration issues and human error. This number is extremely notable because it is preventable.

For example, a leading cause behind misfiled claims is improper payer location. It can be hard to locate the right locality to file to, especially for massive insurance companies. Mistakes on this level cost the consumer and the payer alike. The process of refiling a claim can cost the consumer their coverage and the payer time and resources.

It’s in everyone’s best interest then to reduce these mistakes. Some things which have had a massively positive impact are digital card readers. While these still require some manual input, they can at least reduce simple input errors. The real innovation, something which can help even with localities, are AI-powered card readers.

AI insurance card capture card readers are explicitly trained on insurance payers, companies, and localities. This gives them the unique power of recognizing and processing insurance all at once. Errors drop massively and speed and efficiency rise rapidly under these new readers. There’s a lot of complexity to insurance in the U.S. Misfiled claims represent how this complexity can be harmful, but card readers are one massive step forward to reducing that.

Source: OrbitHC